“What’s in a name? That which we call a rose by any other name would smell as sweet. ~ William Shakespeare” How did the name silver originate? The name silver comes from the Germanic language. Seolfor (Silver) comes from early Anglo-Saxon times. Many people believe silver got its name from the color of the Turkish river Lycia and the reflection of the water.

Silver is a very reflective material, maybe the most reflective metal. The chemical symbol for silver is Ag, which comes from the Sanskrit word Argunas. The reflective nature of this metal appears from its chemical symbol. The word Argunas (Ag) means shiny.

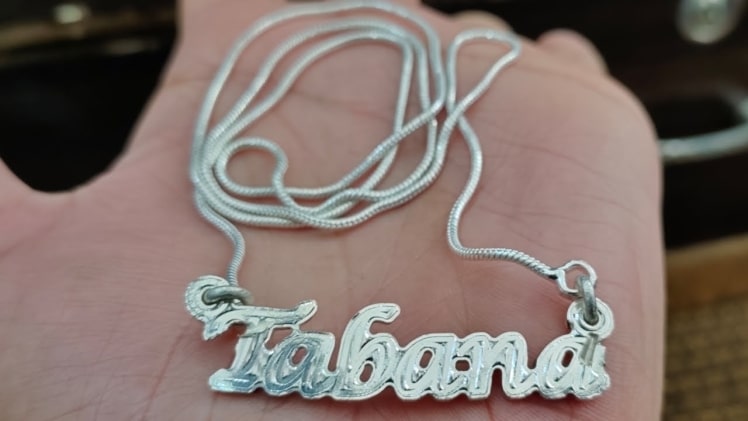

Because silver has a shiny finish, it adds style and luxury to products. It transforms ordinary products into luxurious products such as cutlery and drinking cups. Mirrors and telescopes are examples of products made from silver through the years.

The term silver goes as far back as the book of Genesis in the Bible. We do not know when man started mining silver. We know that archaeologists discovered the parts of silver smelting furnaces that date to 4000 BC.

Silver is one of only seven metals, combinedly referred to as “Seven Metals of Antiquity” known to man. The remaining five are Gold, Copper, Iron, Lead, and Mercury. Mining gold and copper in nugget form is common, but silver rarely occurs in a pure, natural metallic state.

Lead deposits contain silver, and you need to separate the silver from the metal. The extraction process of silver is through heat and chemical applications to separate the silver from other metals and impurities. The final product is a soft metal that is bendable and machinable.

Throughout the ages, silver was a trading commodity. The elite and military paid their workers in silver coins. Because industry uses silver in many applications, the demand for silver is high. Investors buy silver coins to profit from the volatility in the price of silver.

Dealers will buy silver coins and silver bars from you. If you want to buy silver, it is easy to find dealers to purchase silver from. There are many online dealers and ones located in CBD’s, you must compare the prices that the dealer offers to buy silver from you.

Bear in mind that you will buy the silver at 6-8% over the spot price of silver. The dealers will charge a premium to sell the silver to you. Investors will sell silver when the silver price is high and buy it when the price is low.

Because silver is a wealth accumulator, investors will hold onto their silver bars and coins if the economy is losing steam or when inflation is in a rising pattern. It is clear that silver shines through the ages.

Silver is an abundant resource with many industrial uses. Although the price of silver is highly speculative, silver bullion remains a sought-after investment. It is also a wealth accumulator. The metal shines through the ages as a hedge in uncertain and inflationary times.